Texas Flood Recovery Guide 2025

What to Do If You’re Affected — With or Without Insurance IN REMEMBRANCE AND REVERENCE: TEXAS FLOODS OF 2025OUR HEARTS GO OUT TO ALL THOSE AFFECTED. FAMILIES HAVE BEEN TORN APART, COMMUNITIES...

Jul 23 2025 19:59

What to Do If You’re Affected — With or Without Insurance

IN REMEMBRANCE AND REVERENCE: TEXAS FLOODS OF 2025

OUR HEARTS GO OUT TO ALL THOSE AFFECTED. FAMILIES HAVE BEEN TORN APART, COMMUNITIES SHAKEN, AND FUTURES FOREVER ALTERED. WE MOURN WITH THOSE WHO LOST LOVED ONES FAR TOO SOON AND HONOR THE BRAVERY OF FIRST RESPONDERS, VOLUNTEERS, AND NEIGHBORS WHO STEPPED FORWARD IN THE DARKEST HOURS.

This tragedy has shown both the fragility of life and the strength of our shared humanity. Damage and economic losses are estimated between $18 and $22 billion, underscoring the long road ahead.

To support that recovery, weʼve created a Texas Flood Recovery Guide — a practical resource to help individuals and businesses, insured or not, navigate the steps toward financial recovery and rebuilding.

To the grieving, the displaced, and the heroes among us — we see you, we stand with you, and we honor your resilience.

Given the magnitude of this disaster, affected individuals and businesses must understand their options for recovery. Whether youʼre insured or not, our complimentary Texas Flood Recovery Guide will help you take clear, informed steps toward financial recovery after the devastating July floods.

OVERVIEW

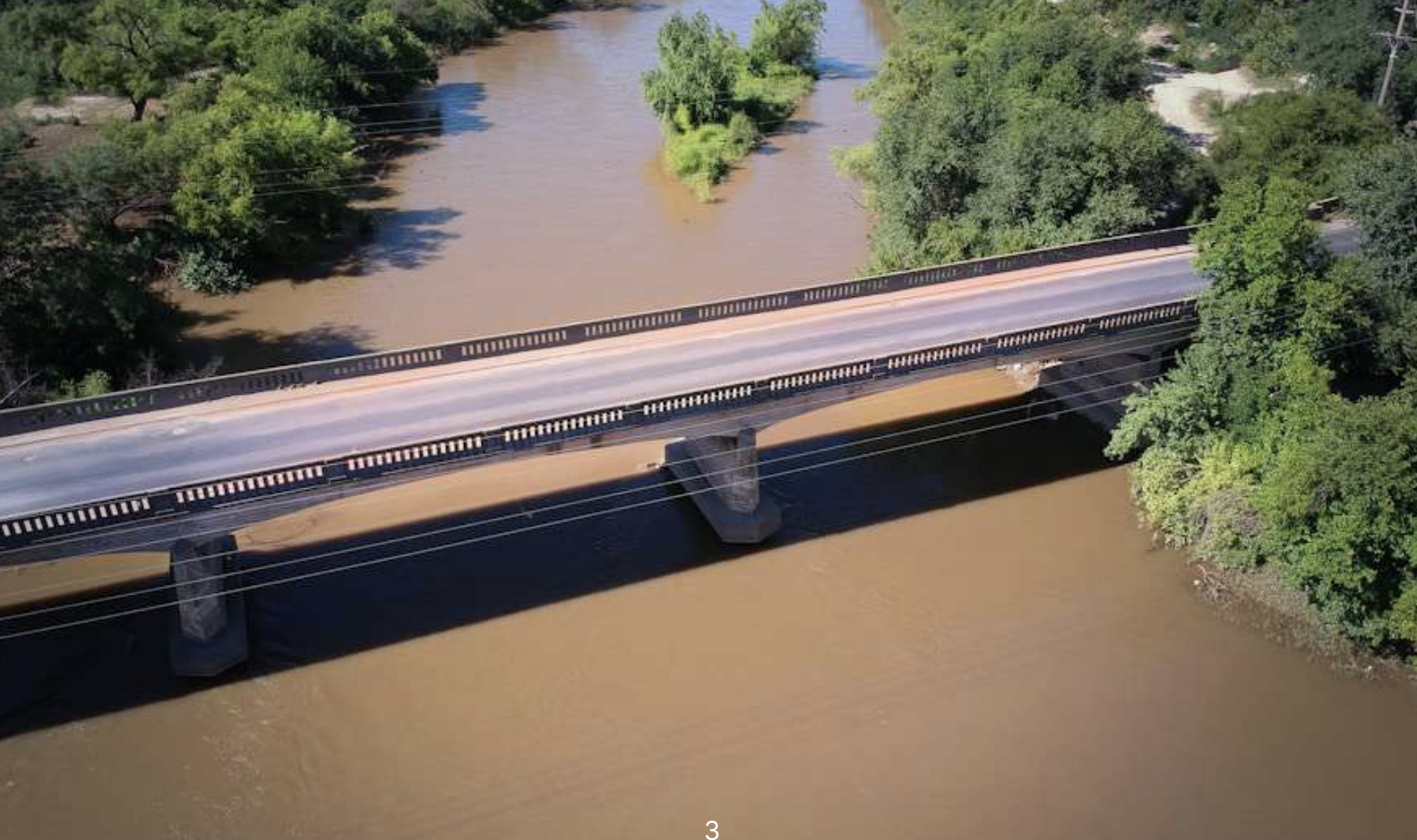

In July 2025, catastrophic flash floods struck Central Texas, particularly devastating the Hill Country and Kerr County, where the Guadalupe River overflowed and swept through communities like Camp Mystic. This event is being called one of the deadliest floods in Texas history, claiming over 100 lives and displacing thousands.

According to AccuWeather, the economic toll is projected between $18 billion and $22 billion — affecting infrastructure, homes, small businesses, and the long-term livelihoods of Texas residents.

But here’s the most alarming fact:

OVER 80% OF THOSE AFFECTED DID NOT HAVE FLOOD INSURANCE.

UNDERSTANDING FLOOD INSURANCE COVERAGE

NFIP (NATIONAL FLOOD INSURANCE PROGRAM)

Most standard homeowners insurance does not cover flood damage.

NFIP is the government-backed option managed by FEMA:

🏠 Residential: Up to $250,000 for the building + $100,000 for contents

🏢 Commercial: Up to $500,000 for both structure and inventory

❌ No coverage for temporary housing, business interruption, or vehicles

Learn more or check your flood zone at FloodSmart.gov

PRIVATE FLOOD INSURANCE

Private carriers often provide:

💰 Higher coverage limits

🏨 Loss of use/ALE (additional living expenses)

⏱️ Shorter waiting periods (714 days vs NFIPʼs 30 days)

Top providers include:

- Neptune Flood

- Palomar Specialty

- Chubb

For an expert review, see CNBCʼs 2025 Flood Insurance Rankings

FILING A FLOOD INSURANCE CLAIM

If you do have flood coverage (NFIP or private):

01 📞 Report the loss immediately to your insurer

02 📸 Document damage: Photos & videos before cleanup

03 📂 Submit Proof of Loss within 60 days for NFIP (or as required by private policies)

04 🧾 Keep all receipts for mitigation, repairs, lodging

Need help with documentation or policy interpretation? ICRS can help.

WHAT IF YOU DON’T HAVE FLOOD INSURANCE?

IF YOU’RE AMONG THE 80% OF TEXANS WHO LACKED COVERAGE DURING THIS DISASTER: YOU MAY STILL BE ELIGIBLE FOR:

💵 FEMA Assistance ➤ DisasterAssistance.gov

🏦 SBA Disaster Loans ➤ SBA Disaster Loan Portal

🧒 Nonprofit & Relief Help ➤ Red Cross | United Way

NOTE: GRANTS ARE LIMITED AND DO NOT REPLACE FULL PROPERTY VALUE. LOANS MUST BE REPAID.

DO I NEED TO WAIT FOR AN INSURANCE ADJUSTER BEFORE STARTING REPAIRS?

YES AND NO.

Knowing what to repair immediately versus what to wait on can protect your insurance claim and avoid denied or reduced coverage. Here's a detailed breakdown for policyholders dealing with flood or property damage:

- You should begin emergency mitigation (like water removal) immediately after taking photos and video of all affected areas holding moisture

- Save all receipts and document everything thoroughly for your claim file.

WHAT ITEMS CAN I REPAIR IMMEDIATELY (EMERGENCY MITIGATION)?

DOCUMENT EVERYTHING BEFORE AND DURING REMOVAL:

- Take photos and videos of all damage, removed materials, and emergency work performed.

- Keep all receipts.

THESE ACTIONS ARE ENCOURAGED TO PREVENT FURTHER DAMAGE AND PROTECT SAFETY:

- Water removal/pumping out standing water

- Removing soaked carpet, drywall, and insulation

- Boarding up broken windows or doors

- Tarping roof leaks

- Shutting off electricity or gas if unsafe

- Drying out property with fans, dehumidifiers, and air movers

- Removing mold-prone materials (if safe and documented)

- Securing the structure (temporary shoring or fencing)

INTERIOR PROPERTY MATERIALS REQUIRING IMMEDIATE MITIGATION AFTER A FLOOD

1. Drywall / Sheetrock

- Highly absorbent and prone to mold within 2448 hours

- Must be removed at least 1224 inches above the water line (a practice known as a “flood cut”)

2. Carpet and Padding

- Traps contaminated water and bacteria

- Should be removed immediately, especially in Category 2 or 3 water (gray/black water)

3. Insulation (Behind Walls)

- Fiberglass, cellulose, and foam insulation retain moisture

- Must be removed once drywall is opened to prevent mold and rot

4. Baseboards and Trim

- Often made of MDF or wood, they absorb water quickly and should be detached for drying or replacement

5. Flooring (Wood, Laminate, Engineered)

- Buckles and warps easily after exposure to standing water

- Must often be removed to allow subfloor drying

6. Subflooring

- Plywood and OSB subfloors can delaminate and retain moisture

- Needs thorough inspection and drying using professional equipment

7. Cabinetry and Vanities

- If water-saturated from below, toe-kicks and particle board bases may swell and fail

- Professional evaluation recommended before attempting to salvage

8. HVAC Ducting and Systems (IfFlooded)

- Water intrusion in ducts can spread mold and contaminants

- Requires disinfection and sometimes full duct replacement

9. Electrical Outlets and Wiring (Below Flood Line)

- Must be inspected by a licensed electrician

- May need rewiring or breaker replacements if submerged

WHAT ITEMS SHOULD I WAIT ON UNTIL THE INSURANCE ADJUSTER ARRIVES?

YOU SHOULD AVOID FULL REPAIRS OR REPLACEMENTS OF THE FOLLOWING ITEMS UNTIL AFTER THE ADJUSTER INSPECTS AND DOCUMENTS THE DAMAGE.....

🛑 DO NOT REPAIR OR REPLACE YET:

🛑 Drywall and Interior Wall Rebuilds

– Avoid reinstalling drywall, insulation, or trim.

🛑 Flooring (Wood, Laminate, Tile)

– Donʼt refloor or refinish until damages are inspected.

🛑 Cabinetry and Built-Ins

– Leave damaged cabinets in place if safe.

🛑 Roof Replacement

– Tarp only; wait on permanent roof repairs until adjuster approval.

🛑 Electrical and Plumbing Repairs (non-emergency)

– Hold off on full rewiring, fixture replacement, or re-plumbing until

approved.

🛑 HVAC System Replacement

– Donʼt install a new furnace or A/C system without adjuster sign-off.

🛑 Appliance Replacement

– If flood-damaged, document them in place and leave for inspection.

🛑 Structural Framing or Demolition

– Do not remove walls, beams, or ceilings unless they pose an immediate

safety hazard.

GOLDEN RULE:

Document Before You Act

- Photograph everything, including serial/model numbers

- Save samples of flooring, drywall, or carpet

- Make a contents inventory with estimated values

HOW TO VET A WATER MITIGATION CONTRACTOR

Hiring a trustworthy contractor is critical after a flood.

✅ Choose certified professionals from IICRC

✅ Ask for proof of insurance & licensing (TDLR lookup)

✅ Get a written estimate and avoid verbal promises

🚩 Be cautious of storm chasers, scams, or pressure sales

HOW ICRS HELPS POLICYHOLDERS

Insurance Claim Recovery Support (ICRS) is a licensed public adjusting firm that exclusively represents and advises policyholders, never insurance companies.

With over 15 years of experience and more than 500 large-loss claims handled, we can help you:

📑 Review and interpret your policy

🧭 Navigate The Claim Process Efficiently

🛠 Document damage & scope of loss

🧾 Support your burden of proof to your insurer

💼 Negotiate for a fair and prompt settlement

🛡 Avoid delays, underpayment, or wrongful denials

📍 Consultations available

💬 Visit: www.insuranceclaimrecoverysupport.com

📞 Call: (512) 904-9900

PREPARING FOR FUTURE FLOODS

Even if you weren’t hit this time, now is the time to prepare:

✅ Buy flood insurance now

➤ FloodSmart.gov

📋 Create a home inventory with photos and receipts

🧱 Flood proof your home (elevate HVAC, waterproof materials)

🔁 Review coverage annually to match property values and risk

TEXAS FLOOD RECOVERY POLICYHOLDER CHECKLIST

Use this to guide your insurance claim process aftera flood.

1. INITIAL ACTIONS

Report loss immediately to your insurer (NFIP or private carrier)

✅ Document all damage thoroughly before cleanup:

☐ Photos and videos of each affected area

☐ Close-ups of damaged property/materials

☐ Serial/model numbers on appliances and electronics

✅ Begin emergency mitigation (only after documentation):

☐ Water removal/pumping standing water

☐ Drying property with fans, dehumidifiers, air movers

☐ Tarping roof leaks

☐ Boarding broken windows/doors

☐ Disconnecting electricity or gas if unsafe

2. EMERGENCY REPAIRS YOU CAN DO IMMEDIATELY

✅ Remove and document:

☐ Soaked carpet and padding

☐ Drywall/sheetrock (remove 1224 inches above waterline — flood cut)

☐ Wet insulation behind walls ☐ Baseboards and wood trim

☐ Water-damaged wood, laminate, engineered flooring

☐ Swollen cabinets, toe-kicks, or particle board bases

☐ HVAC ductwork affected by flooding

☐ Mold-prone or saturated materials

3. Repairs to DelayUntil Insurance Adjuster Arrives

🔴 Do NOT repair or replace these before inspection:

🔴 Drywall and interior wall rebuilds

🔴 Full floor replacement (tile, wood, laminate)

🔴 Cabinetry and built-ins

🔴 Roof replacement (temporary tarping okay)

🔴 Electrical/plumbing repairs (non-emergency)

🔴 HVAC system replacement

🔴 Appliance replacement

🔴 Major structural framing/demolition

4. Recordkeeping

☐ Save all receipts (repairs, mitigation, lodging)

☐ Make a contents inventory with estimated values

☐ Store damaged material samples (flooring, carpet, drywall) for inspection

5. Contractor Vetting

✅ Before hiring water mitigation contractors:

☐ Ensure contractor is certified (IICRC recommended)

☐ Verify licensing and insurance (TDLR lookup)

☐ Obtain a written estimate ... avoid verbal promises

☐ Be cautious of storm chasers, scams, or high-pressure tactics

6.Proofof Loss Submission

☐ Submit Proof of Loss within 60 days for NFIP policies (check for private policy deadlines)

7. Additional Resources

- If uninsured or needing assistance:

- Apply for FEMA assistance: DisasterAssistance.gov

- Consider SBA Disaster Loans: SBA Disaster Loan Portal

- Seek help from nonprofits: Red Cross, United Way

✅ Golden Rule Reminder:

☐ “Document before you act”

☐ Photos, videos, receipts, samples, inventory

FINAL WORD

Flood recovery is overwhelming but, you don’t have to go it alone.

Whether you're insured or uninsured, ICRS is here to guide you, protect your interests, and ensure you receive what you're owed.